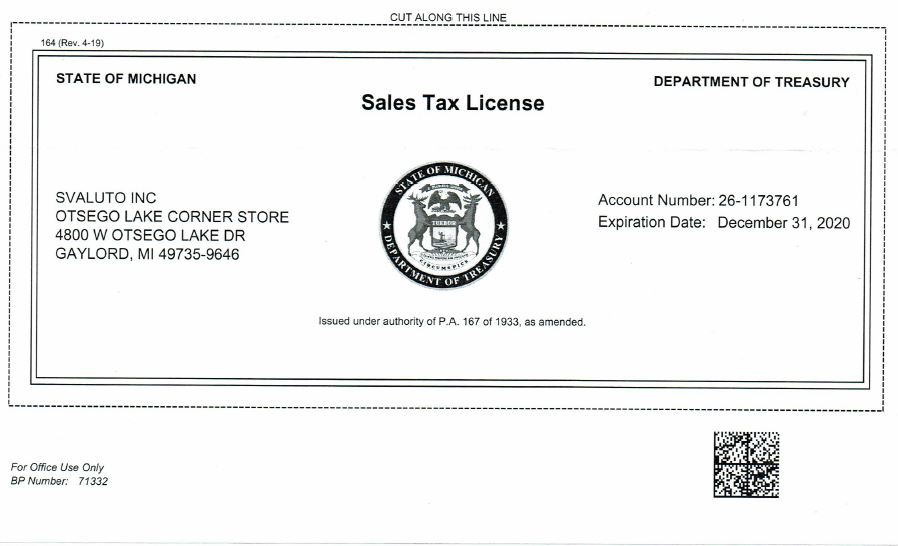

michigan use tax license

Minimum 6 maximum 15000 per month. Sales Use Tax Licensure.

How Much Is Llc In Michigan Costs Your Need To Know

Use tax applies to the rental use of tangible personal property in the State of Michigan.

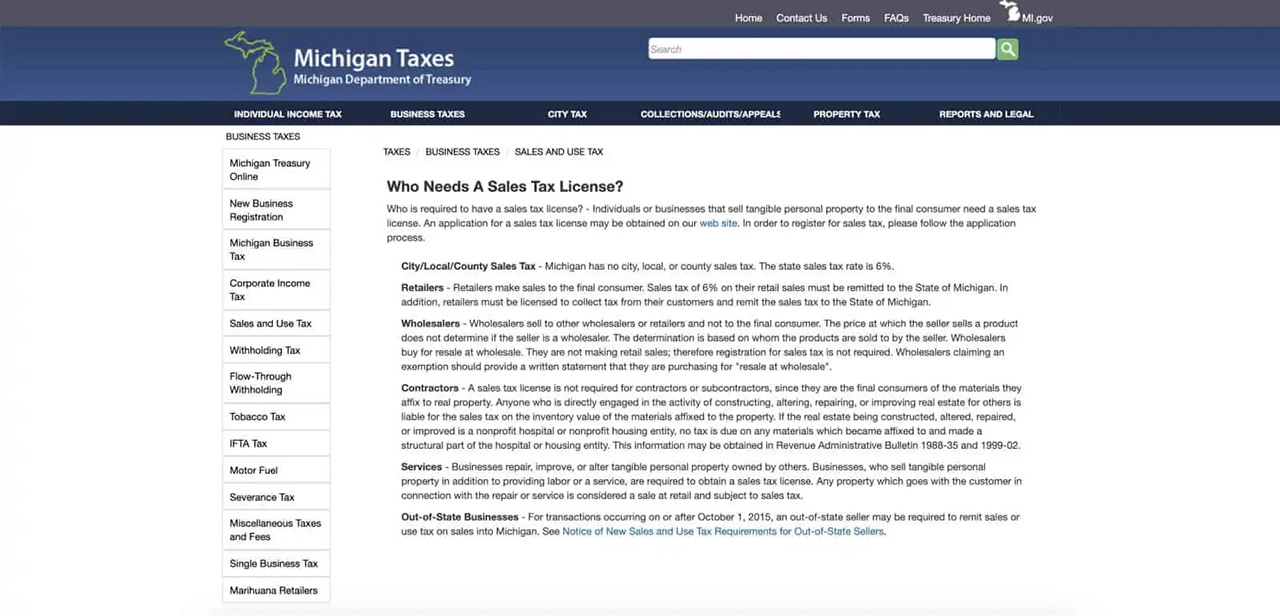

. As of March 2019 the Michigan Department of Treasury offers. If you have questions about the sales tax license the Michigan Department of Treasury has a guide to the Michigan Sales Use Tax or can be contacted by calling 517-636. Michigan Taxes tax income.

Notice of New Sales Tax Requirements for Out-of-State Sellers. If you have quetions about the. Get Your Michigan Sales Tax License Online.

What is the Michigan. The procedure to get a sales tax permit Michigan is described below. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Please reference the Tobacco Tax License Application Instructions for a checklist of required documents for each license type. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax. The MI use tax only applies to certain purchases.

If you have any additional questions regarding the. An online application is completed to the Michigan Department of Revenue web-site to get sales and use tax permit. Welcome to Michigan Treasury Online MTO.

Michigan Department of Treasury. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in. See Use Tax below for examples of transactions that may be subject to use tax.

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372. In the state of.

Treasury is committed to protecting sensitive taxpayer. This section applies to businesses that are applying for a license in Michigan for the first time. You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website.

An on-time discount of 05 percent on the first 4 percent of the tax. Streamlined Sales and Use Tax Project. This is also the states preferred method Simply following the steps outlined on this New Business.

The easiest way to get your sales tax license in Michigan is online. New Business Registration About the Streamlined Sales and Use Tax Project Online Business Registration Michigan Business Tax Michigan Business Tax. MTO is the Michigan Department of Treasurys web portal to many business taxes.

2022 Michigan state use tax.

Michigan Sales Use Tax Guide Avalara

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

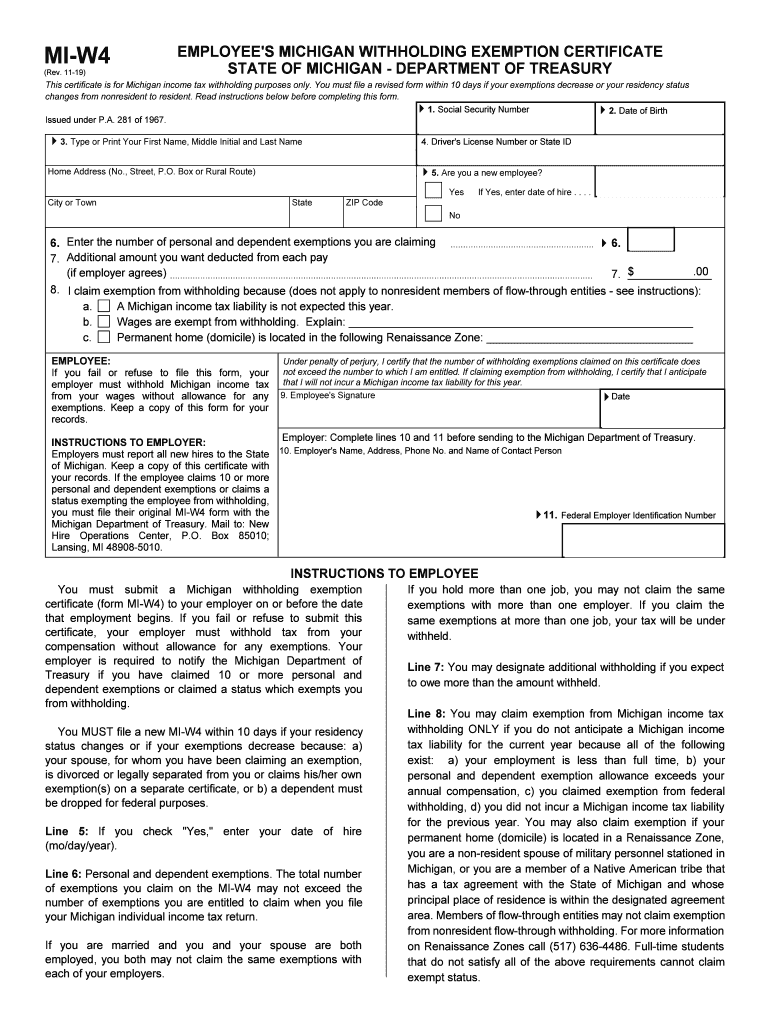

Michigan Withholding Fill Out Sign Online Dochub

Ask Us First A Program By Michigan Retailers Association

How To Register A Dba In Michigan Forbes Advisor

How To Register For A Sales Tax Permit Taxjar

Michigan Sales Tax Handbook 2022

How To Register For A Sales Tax Permit In Michigan Taxvalet

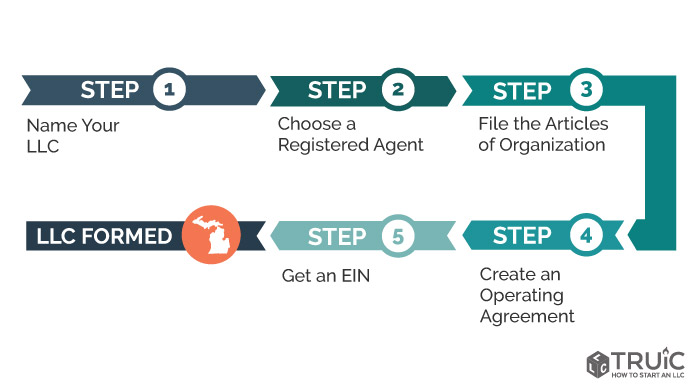

Llc Michigan How To Start An Llc In Michigan Truic

Michigan Pet Stores Shop Pet Supplies In Michigan

Sales Tax Laws By State Ultimate Guide For Business Owners

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Sales Tax License When You Need One And When You Don T Article

Vintage 1932 Dog Tag License Tax Registration Lapeer Co Michigan Antique 15 Ebay